Finding the perfect home can be an thrilling journey, but navigating the mortgage process can sometimes feel daunting. That's where private mortgage loans come in. These unique financing options offer a attractive alternative to traditional mortgages, allowing you to achieve your homeownership goals.

Private lenders often provide relaxed lending criteria, which can be significantly beneficial for borrowers with unique financial circumstances. Whether you're freelance, have a recent credit history, or simply need faster loan approval, private mortgage loans can be a powerful tool.

Ready to undertake your journey to homeownership with the support of a private mortgage loan? Speak with our team of experienced lending professionals today to explore how we can help you secure your dream home.

Unlocking Homeownership: Private Home Loans for All Credit Situations

The path to homeownership doesn't have to be simple. Even with less-than-perfect credit, achieving your dream home is within reach. Private home loans offer a compassionate lending solution that reviews your individual financial situation. These loans can offer the funding you need to obtain a home, regardless of your credit history. With a private lender, you may discover more understanding terms and guidelines that align your specific needs.

Investigate the possibilities of private home loans and see how they can help you on your journey to homeownership. A qualified lender can analyze your specific situation and create a customized loan program that meets your aspirations.

Discovering Your Perfect Lender: Navigating Private Mortgage Options

Securing a mortgage is Bad Credit Home Loan an essential financial decision. With the traditional lending landscape becoming increasingly challenging, many borrowers are exploring non-conventional mortgage options. These private lenders often offer flexible loan programs that may be a better solution for certain circumstances.

Yet, navigating the world of private mortgages can seem overwhelming. It's essential to be aware of the varieties between private lenders and mainstream banks, as well as the advantages and cons of each option.

Here delve into some key factors to consider when choosing a private mortgage lender:

* **Loan Products:** Private lenders often concentrate in particular loan products, such as those for fixer-uppers.

* **Interest Rates and Terms:** Interest rates and loan terms can fluctuate widely among private lenders. Meticulously compare offers from multiple lenders to ensure you're getting the best viable deal.

* **Lender Reputation:** Research the history of any lender you're considering. Look for feedback from other borrowers and check with the Better Business Bureau.

By thoughtfully evaluating your preferences and conducting thorough research, you can locate a private mortgage lender that's the optimal solution for your circumstances.

Conquering Bad Credit: Accessing Private Mortgage Solutions

Achieving the dream of homeownership can seem impossible when faced with bad credit. However, don't give up. There are unique mortgage solutions available specifically designed to help individuals with less-than-perfect credit histories. Private lenders often offer lenient underwriting guidelines and consider factors beyond just your credit score, such as income stability and equity position. By exploring these choices, you can increase your chances of securing a mortgage and finally acquire the home of your dreams.

- Explore various private lenders to locate one that best suits your needs.

- Improve your credit score before applying for a mortgage by reducing outstanding balances.

- Consult with a mortgage broker who specializes in private lending to gain personalized guidance and support.

Non-Bank Loans: A Personalized Approach to Home Financing

Private lending presents a alternative pathway for individuals seeking home financing. Unlike traditional banks, private lenders often provide flexible terms and consider applications based on a broader range of factors. This individualized approach can be particularly favorable for borrowers who may not meet conventional mortgage standards.

Private lenders frequently lend funds for a variety of home financing needs, including:

* Purchase of primary residences.

* Improvement projects.

* Vacation property acquisitions.

By providing a streamlined approval process and competitive interest rates, private lending can be a feasible solution for borrowers seeking funding.

Discover Private Home Loan Opportunities Today!

Take command of your aspiration home adventure by exploring the unconventional world of private home loans. Get pre-approved swiftly and learn about what financing options are at your disposal for you. Don't wait this opportunity to make your homeownership goals a reality.

Begin your journey today and contact our expert loan specialists to understand the benefits of private home loans.

Kel Mitchell Then & Now!

Kel Mitchell Then & Now! Brian Bonsall Then & Now!

Brian Bonsall Then & Now! Tatyana Ali Then & Now!

Tatyana Ali Then & Now! Destiny’s Child Then & Now!

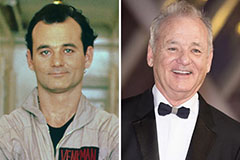

Destiny’s Child Then & Now! Bill Murray Then & Now!

Bill Murray Then & Now!